As in past years, the World Artificial Intelligence Conference (WAIC) offered plenty to see. But this time, the atmosphere felt different.

The sweltering heat and crowded booths were familiar, but one change stood out: the buzz around foundation models had diminished. In its place, a new question echoed across the show floor, raised by both exhibitors and attendees: are there any real-world use cases?

After three years of market education, users have grown weary of flashy leaderboard performances. The fatigue is clear. In 2025, after DeepSeek’s sudden rise and the collapse of numerous artificial intelligence projects, a sense of urgency has emerged among founders and investors.

But not everyone is in a rush.

According to 36Kr, one Shanghai-based foundation model developer has quietly exported its technology to Africa, the Middle East, Europe, Southeast Asia, and Russia.

This company focuses on “offline intelligence,” pushing the boundaries of large model deployment to reach low-cost devices. Its technology enables real-time AI computation on low-spec AI PCs, smartphones, drones, and robots, all without relying on an internet connection. In regions with unstable connectivity, such as parts of Africa, Russia, and the Middle East, that kind of local processing is not just a bonus. It is essential.

The company avoids flashy promotion and rarely runs promotional or marketing campaigns. Internally, the team refers to its goal not as appearing sophisticated but as breaking into Huaqiangbei.

To outsiders, that might sound like modest ambition. But to industry insiders, it signals something else. Huaqiangbei, a district in Shenzhen, is one of the world’s most competitive electronics hubs, known for fast iteration, slim margins, and large-scale production. It is a proving ground where unicorns are forged, often without fanfare.

The startup’s name is RockAI.

The low-profile unicorn

Founded in June 2023, RockAI is a majority-owned subsidiary of Stonehill Technology, a publicly listed company in China. Its flagship product is Yan, a general-purpose large model architecture that forgoes the now-standard attention mechanism. Instead, it is designed from scratch to support real-time, offline computation on low-power devices.

Unlike traditional approaches that distill or prune large models, RockAI builds from first principles. Its architecture does not follow designs from OpenAI, Meta, DeepSeek, or other common benchmarks.

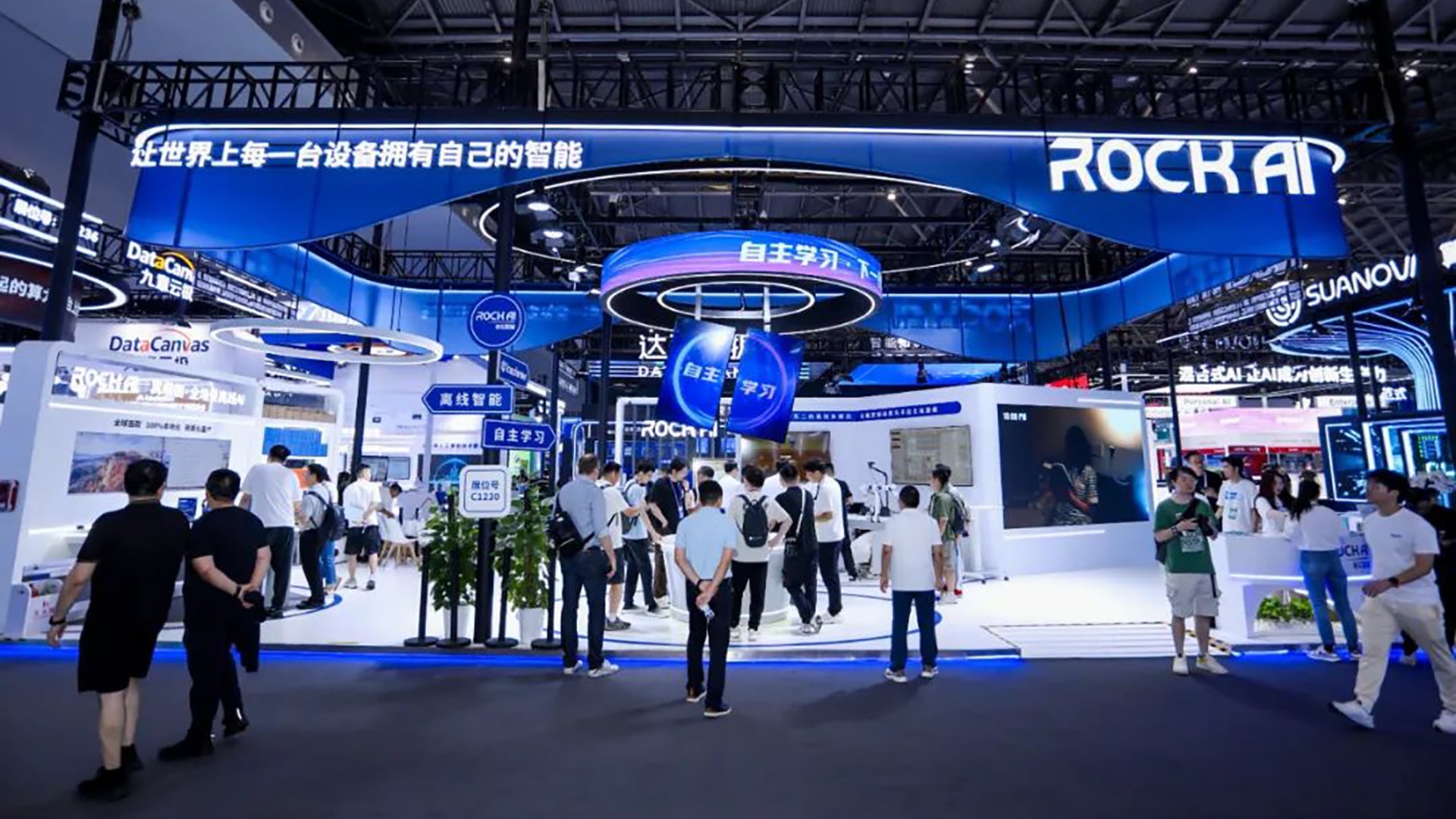

At this year’s WAIC, RockAI previewed its Yan 2.0 model. The new version extends its multimodal capabilities to video and introduces a neural memory unit, which may grant the model a degree of autonomous learning.

Key attributes of the model include low power consumption, high performance, offline capabilities, and a non-transformer framework. These are exactly what draw customers to RockAI.

Offline intelligence in action

At MWC 2025 in Barcelona, one vendor showcased an AI PC running RockAI’s model. The response, according to the vendor, was “explosive.” Distributors from Europe, Africa, and Russia placed immediate orders. Competitors at nearby booths expressed disbelief that such a model could run offline at the listed price point.

The excitement reflects a growing need: many overseas users require offline capabilities.

Consider one of RockAI’s most popular features: a smart meeting assistant that offers live transcription, translation, note-taking, and summaries during video calls. While common in China’s enterprise tech stack, this is a breakthrough for foreign businesses that enforce strict data privacy policies and prohibit cloud-based processing. For them, local AI is more necessary than convenient.

Connectivity issues are also a recurring problem. Devices that perform reliably in China’s 5G environment often struggle abroad, where networks can be costly, inconsistent, or non-functional. Ten-minute loading screens that end in error messages are routine in some regions.

Even within China, interest is growing in deploying foundation models locally and differentiating AI features at the product level.

In the past, advanced AI capabilities such as facial recognition, voice recognition, and optical character recognition were limited to premium devices. Now, due to progress in algorithms, chips, microphones, and camera modules, these features are increasingly common in budget smartphones and even offline appliances like lamps, refrigerators, washing machines, and rice cookers. This mirrors the evolution of other cutting-edge technologies, and foundation models appear to be following the same path.

Devices powered by RockAI are already shipping in meaningful volumes. The company’s clients include consumer electronics brands, smartphone makers, robotics firms, automotive chip vendors, and manufacturers of home appliances and smart glasses. Many of these customers are based in Huaqiangbei, where market awareness is particularly sharp.

The memory of a model

As competition in large models fades, many companies are pivoting or preparing for IPOs. While others talk, RockAI continues to ship globally. Its accumulated technology stack and engineering expertise have put it ahead of many rivals. It is one of the most quietly influential players in the field of foundation models.

RockAI’s ambitions extend beyond phones, laptops, or appliances. The company’s broader goal is artificial general intelligence (AGI), a pursuit that takes center stage with Yan 2.0. Memory is a core feature of the new model.

To demonstrate, RockAI presented a robotic dog running Yan 2.0, showing what it means for a model to “remember.”

Unlike traditional models that rely on external tools like retrieval-augmented generation (RAG), RockAI’s approach embeds memory directly into the model’s parameters. This allows for long-term memory and a more personalized understanding of users.

This is not a matter of temporary caching. The memory develops through repeated user interaction, enabling devices to recognize and adapt to individual users over time. As a result, the devices become cognitive extensions rather than just tools. And because everything runs on-device, the process is secure, private, and fast.

RockAI argues that just as human intelligence develops through memory and experience, AI must follow a similar trajectory if it is to evolve into a true assistant. Only by remembering user preferences, contexts, and past interactions can a model provide personalized services.

In RockAI’s view, once every device can remember and learn, they no longer function as isolated systems. Instead, they become part of an intelligent network that can share experience and evolve collectively. The company believes this type of distributed learning is a crucial step toward AGI.

At a crossroads

It may still be premature to speak seriously about AGI. But even as focus shifts to the present, one thing seems clear: foundation models are at a turning point.

On one hand, the rush to build large models has slowed. Many high-profile projects have failed. The industry is consolidating and downsizing.

On the other hand, there is strong, unmet demand from device makers, brand owners, and users around the world.

The moment recalls 2017, when Huawei, Apple, and Samsung introduced their first AI-powered smartphone chips. That milestone marked AI’s shift from the cloud to the edge.

Now, in 2025, amid a more cautious industry climate, RockAI is quietly making progress. It may be an early signal of where the field is heading.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Xiao Xi for 36Kr.