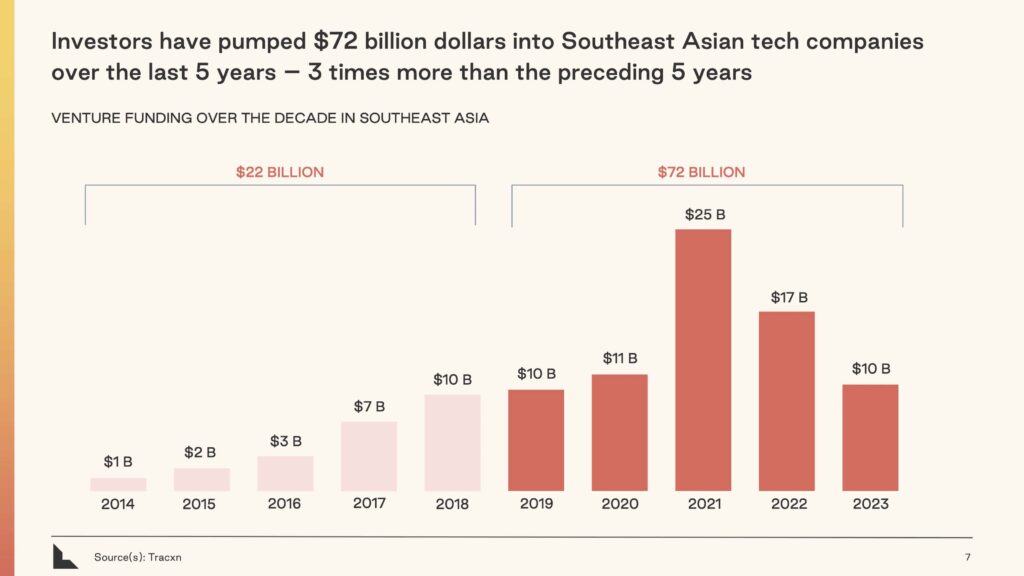

For the better part of the last decade, Southeast Asia has often been framed as the next big frontier for tech investment, following China and India. The region’s rapid digitalization, fueled by a young, tech-savvy population, seemed to echo the growth patterns of these two giants. However, a deeper look reveals that many assumptions based on China and India’s success are fundamentally flawed when applied to Southeast Asia.

This realization is at the heart of a critical shift that Lightspeed Venture Partners—a prominent venture capital firm—urges investors and companies to make. The firm’s latest report points out the misguided belief that Southeast Asia can replicate the growth trajectories of China and India wholesale, highlighting key factors that set the region apart. To truly unlock value in Southeast Asia, Lightspeed asserts that businesses must reset their expectations and adapt to the unique realities of the market.

Southeast Asia isn’t the next China or India

For years, Southeast Asia has been viewed largely through the same lens as China and India, with many assuming the region could follow a similar path of rapid economic growth and tech-driven expansion. Investors expected that scaling in Southeast Asia would require similar playbooks—heavy investment in user acquisition, large-scale market dominance, and a focus on expanding consumer tech offerings.

But this thinking has led to a series of miscalculations, primarily around the monetization potential of Southeast Asian consumers.

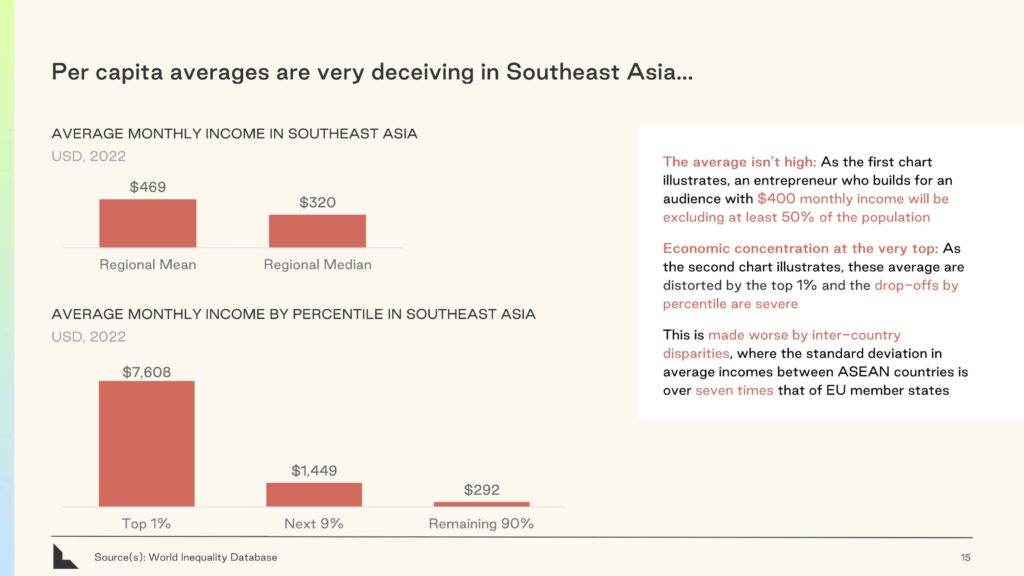

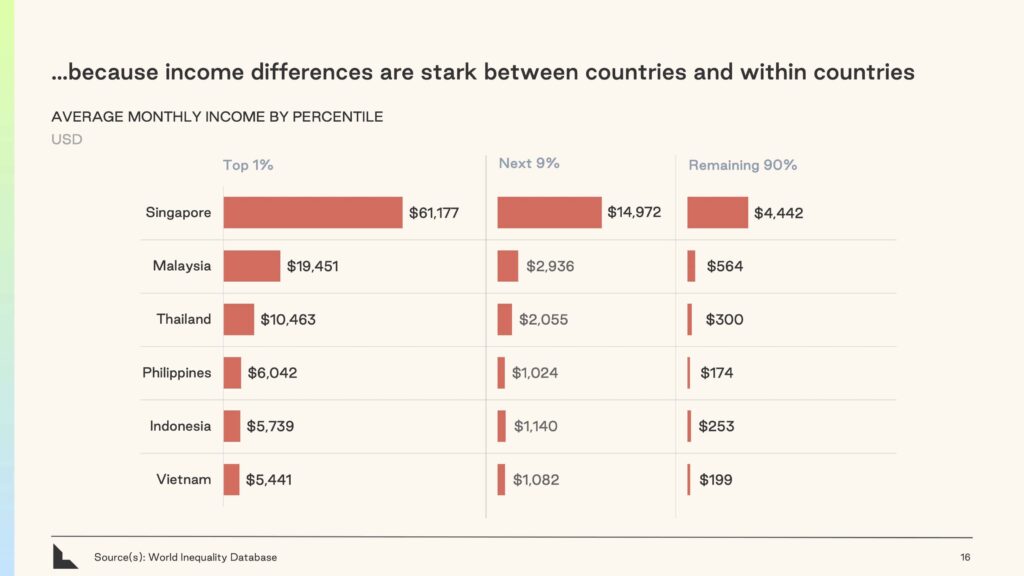

The central issue, as Lightspeed points out in its report, lies in the assumption that Southeast Asia’s consumer markets are homogeneous and primed for scale in the same way China and India’s have been. While the region does have a large and youthful population, the economic realities are far more complex.

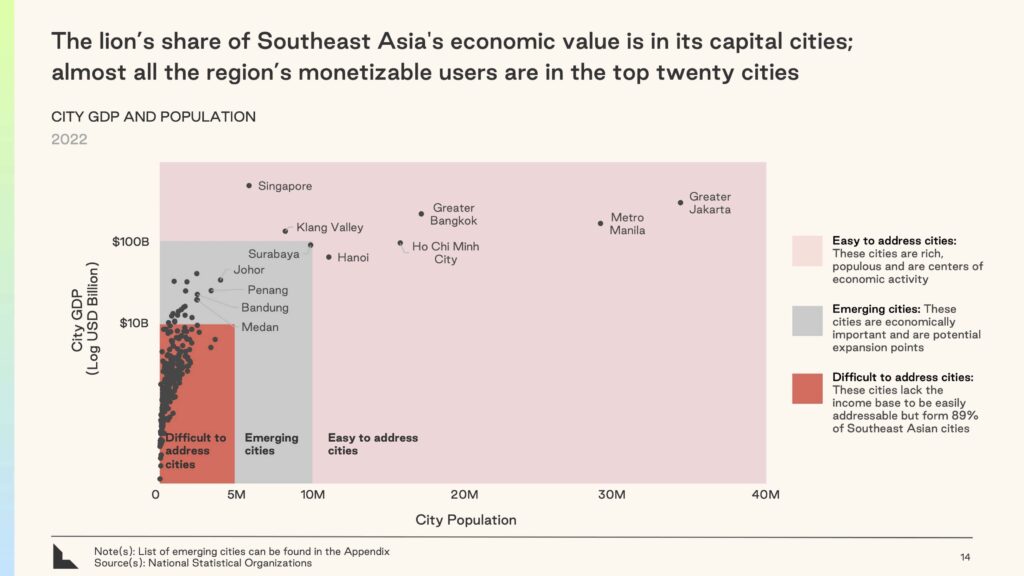

Economic value is highly concentrated in the region’s top 20 cities (based on GDP contributions), and there’s a stark income disparity between urban centers and rural areas.

Average per capita income figures further obscure these realities, creating an illusion of greater spending power than actually exists. Monetizing consumers at scale, as businesses did in China and India, has been far more challenging in Southeast Asia due to these uneven income distributions.

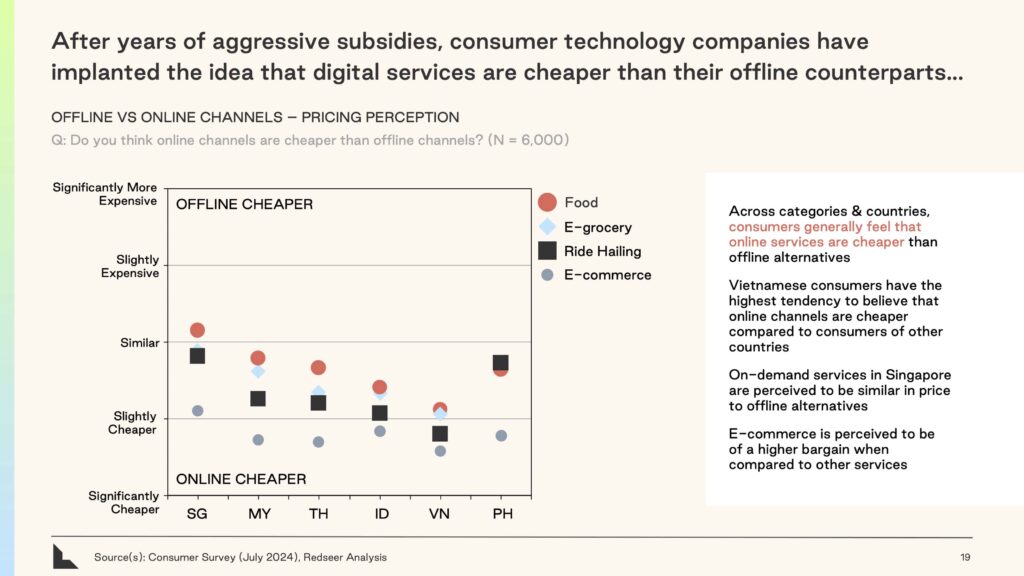

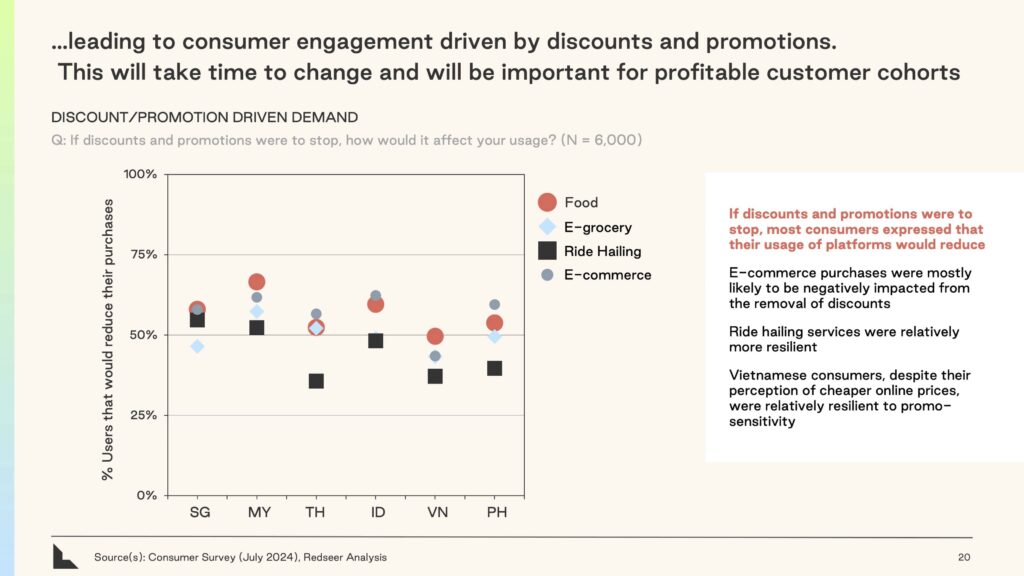

Moreover, Southeast Asia’s consumer behavior patterns differ significantly from those of China and India. Years of aggressive subsidies by tech companies have conditioned consumers in the region to expect digital services at ultra-low prices. From ride-hailing to food and grocery deliveries, many Southeast Asians see online services as cheaper alternatives to offline options, even though these services are typically more expensive to run.

The massive operational costs—hiring delivery riders, managing complex logistics systems, and operating matchmaking algorithms—were previously offset by generous subsidies. But as these subsidies are reduced or removed, businesses found themselves struggling to achieve profitability. This disconnect between consumer expectations and business realities underscores the need for a strategic reset.

Call for a reset

Lightspeed’s message is clear: businesses must realign their expectations and strategies if they want to succeed in Southeast Asia. The firm argues that the region’s unique characteristics—ranging from economic disparities and entrenched consumer behaviors to fragmented infrastructure—require a fundamentally different approach than what worked in China or India.

The reset of expectations involves more than just scaling back growth ambitions—it means acknowledging the structural challenges that exist within the region.

For example, while e-commerce remains a key sector, Southeast Asia’s market fragmentation has made it difficult for any one player to achieve regional dominance. In Indonesia, Shopee’s stronghold is challenged by local competitor Tokopedia, and while Shopee leads in many other Southeast Asian countries, its position is not unassailable.

The entry of TikTok Shop, a platform blending social media content with e-commerce, further illustrates the region’s diversity in consumer preferences. TikTok Shop has found rapid success in markets like Thailand and Vietnam, where live streaming and social commerce resonate deeply with consumer behavior. However, in more mature markets like Singapore, where consumers have more entrenched shopping habits and higher expectations around logistics and service quality, TikTok Shop has yet to achieve the same level of traction.

This patchwork of consumer preferences and behaviors illustrates how varying cultural, social, and economic factors shape the landscape across Southeast Asia. To succeed, businesses need to adopt a more localized approach, tailoring their offerings to the specific needs and preferences of each market rather than seeking broad, region-wide solutions.

Infrastructure and regulatory challenges

Another critical reason why Southeast Asia cannot simply be viewed as the next China or India lies in its infrastructure and regulatory landscape. China’s growth has been facilitated by strong state involvement, with the government directing massive investments into key sectors like technology, renewable energy, and transportation. Decades of infrastructure investment in China have resulted in an efficient and cohesive network that enables rapid scaling for businesses. India, while not as cohesive as China, has seen regulatory support that enabled tech giants to thrive, particularly in sectors like fintech and e-commerce.

Southeast Asia, by contrast, is far more fragmented in both regulatory and infrastructural terms. Each country has its own regulatory frameworks, and these can vary significantly even within countries. For example, Indonesia’s sprawling archipelago presents logistical and regulatory challenges that differ drastically from Singapore’s streamlined business environment. Navigating these inconsistencies requires significant localization efforts, and it’s not uncommon for businesses to encounter roadblocks that slow down expansion or increase operational costs.

It’s worth noting that Lightspeed is not alone in raising these concerns. In June 2023, Adrian Li, founder and managing partner of AC Ventures, echoed similar sentiments in an op-ed published by KrASIA. Li pointed out the inherent risks of using China as a blueprint for success in Southeast Asia. He emphasized that the market dynamics in ASEAN countries are shaped by local factors that cannot be mirrored from China. Both Lightspeed and Li underscore the importance of recognizing Southeast Asia’s diversity, which demands a more flexible and nuanced approach to business strategy.

One of the most striking differences is how government intervention plays out. China’s state-led growth model, characterized by strategic government crackdowns and targeted support, contrasts sharply with Southeast Asia’s more decentralized regulatory approach. In China, for instance, government crackdowns on big tech in recent years have significantly reshaped giants like Alibaba and Tencent, while heavy subsidies for sectors such as electric vehicles and renewable energy continue to propel these industries forward, even in the face of external criticisms from the West.

In Southeast Asia, however, regulatory influence tends to be more of a guiding or moderating force. While governments across the region certainly play a role in shaping industries, they rarely exercise the same level of direct intervention seen in China. Instead, businesses must navigate a patchwork of varying regulations across borders, adding layers of complexity to regional strategies, requiring them to adapt to local conditions while maintaining cohesion across markets.

Ultimately, Lightspeed’s call for a shift is grounded in pragmatism. The firm argues that Southeast Asia isn’t the next China or India, and treating it as such risks missed opportunities and failed ventures. Instead of chasing “growth-at-all-costs,” businesses should focus on strategies that prioritize long-term profitability, local operations, and a nuanced understanding of consumer behavior. This recalibration isn’t a retreat from the region’s promise, but an acknowledgment of its distinct challenges and potential.

Southeast Asia remains a region of immense opportunity, but those opportunities will not be unlocked by replicating models from other markets. Instead, success will come to those who understand the intricacies of the region, tailor their approaches to local realities, and adjust their strategies to build sustainable, scalable businesses.