Nvidia is reportedly developing an internal robotaxi project, according to 36Kr. The plan was announced at a recent company meeting and will be led by senior director Ruchi Bhargava.

People familiar with the matter said the new initiative will follow a single-stage “end-to-end” technology route, in which one neural network is trained and reinforced through simulation-generated world models. This approach is likely similar to Tesla’s “Full Self-Driving” (FSD) system.

In January, Nvidia introduced Cosmos, its world foundation model. The platform integrates text, image, video, and sensor data to generate synthetic video that conforms to physical laws. The model has already been pretrained on more than 20 million hours of data.

Cosmos’ main advantage lies in its ability to create complex driving scenarios that are difficult to reproduce in the real world, expanding the boundaries of autonomous driving capabilities. The direction is already gaining traction in the industry, with Chinese automakers Li Auto and Xpeng developing their own world models.

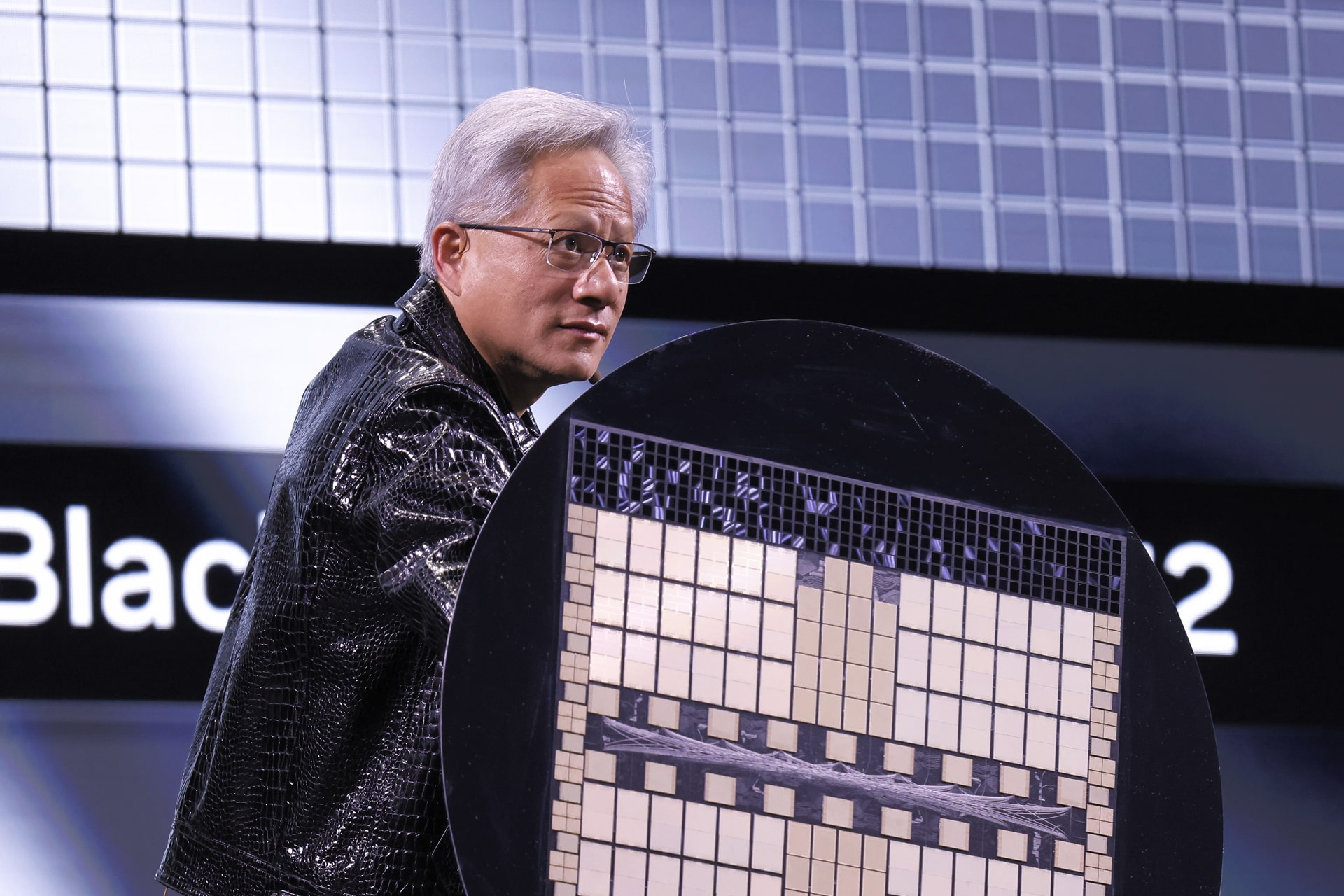

Nvidia has also partnered with General Motors, Mercedes-Benz, and Toyota to co-develop or deploy autonomous fleets powered by its technology. In May, CEO Jensen Huang said that the Level 4 autonomous fleet built with Mercedes-Benz would launch this year.

However, the new robotaxi effort is a separate project. “The company plans to invest USD 3 billion and launch operations in the US,” one person close to the project told 36Kr, adding that budget allocations and objectives are becoming clearer in team discussions.

Not late to the robotaxi race

Huang has repeatedly said that autonomous vehicles represent not only the first major commercial application of robotics but also a sector with significant economic potential. The US robotaxi market appears to support that view, showing signs of acceleration in 2025. Waymo, a leading player, expanded commercial operations to two additional cities, including Austin, and is preparing pilot programs with safety drivers in six more, such as Denver. As of April, Waymo provided more than 250,000 paid rides per week in the US.

Tesla launched its robotaxi service in Austin, Texas, and the San Francisco Bay Area in September. Investors noted that Tesla’s robotaxi app downloads on launch day exceeded Uber’s by roughly 40% and were six times higher than Waymo’s historical peak.

Regulatory changes are also paving the way for growth. The US National Highway Traffic Safety Administration (NHTSA) plans to propose amendments in 2026 that would remove existing rules requiring human drivers and manual controls, enabling robotaxis to adopt vehicle designs without steering wheels. The NHTSA also pledged to shorten the review period for autonomous vehicle exemptions from years to months to speed up deployment.

Despite these developments, the industry remains early in its commercialization phase. Waymo operates about 700 vehicles in the US, while Tesla’s initial fleet in Austin consists of only a few dozen. The debate between Waymo’s and Tesla’s differing technological paths, and how Level 4 autonomy will mature, remains unresolved. The current momentum represents a phase of intensive validation rather than a fully developed market.

For Nvidia, its core strength remains in chips and computing ecosystems, not in fleet operations. “You can think of the robotaxi project as Nvidia’s training ground,” a person close to the team told 36Kr. “In embodied intelligence, large models are widely accepted as the core technology. But in practice, deploying and fine-tuning them in autonomous vehicles is still challenging. Nvidia wants to strengthen that engineering capability.”

Catching up through experimentation

Nvidia began developing autonomous driving software in 2015, but it has yet to release a high-level driving system for mass market vehicles. In 2020, it partnered with Mercedes-Benz to provide artificial intelligence architecture, including an autonomous driving solution and an intelligent cockpit for the automaker’s next-generation vehicles.

According to 36Kr, Mercedes-Benz executives drove from Los Angeles to San Francisco in June 2024 to test Nvidia’s and Momenta’s driver assistance systems over a thousand kilometers. After four years of Nvidia’s work, Momenta’s software, which was tuned in just one month, reportedly performed better. As a result, Mercedes replaced Nvidia with Momenta for assisted driving in several of its models in China.

Nvidia’s challenges extend to Level 4 autonomy. “Nvidia has been benchmarking against Tesla’s FSD internally,” one insider said. “The company conducted multiple comparison tests this year and was surprised by Tesla’s results. On routes between 500–600 kilometers, Tesla’s FSD required only one or two driver interventions. Nvidia still has a sizable gap to close.”

Bhargava, who leads the project, has maintained a low profile. Available records show she has co-authored several of Nvidia’s academic papers on autonomous driving.

From a broader perspective, Nvidia still trails Waymo and Tesla in several areas, including talent depth, production-grade algorithm engineering, complex data accumulation, and on-road testing experience. However, as a core chip supplier, Nvidia has unique advantages in developing robotaxi systems. Its Drive Thor chip, with 2,000 TOPS (tera operations per second) of computing power, could significantly improve end-to-end model inference. Combined with Nvidia’s extensive experience in AI training clusters and software toolchains, this foundation supports rapid model iteration.

Perhaps most importantly, Nvidia has the financial capacity that few autonomous driving companies can match. In the second quarter of 2025, it reported a net profit of USD 26.4 billion, while Waymo’s total investment to reach its current scale is about USD 12 billion. In an AI sector that demands deep capital reserves, Nvidia’s chip business provides the financial cushion for long-term experimentation in the robotaxi space.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Xu Caiyu for 36Kr.