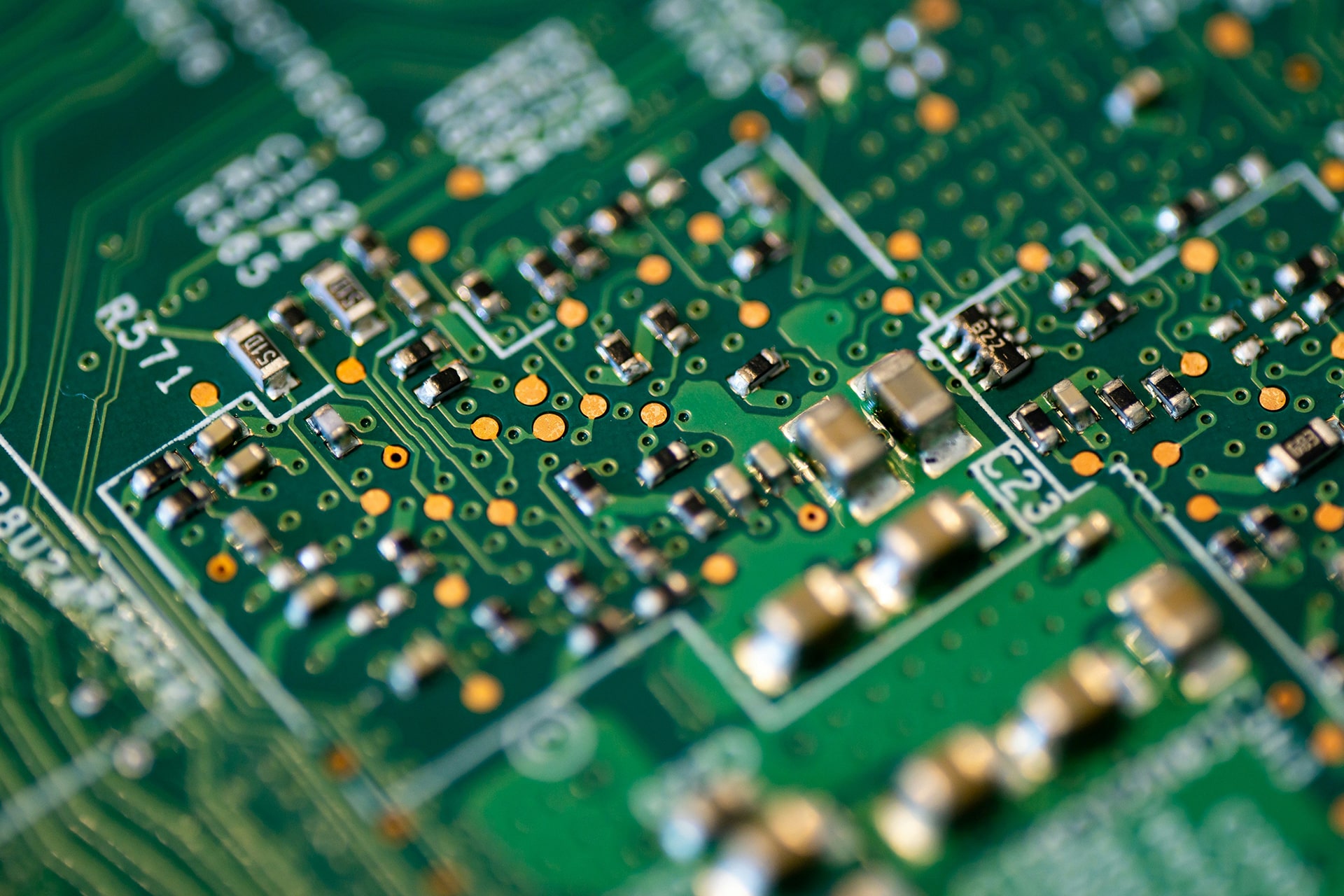

The microchip, or chip for short, is an integral part of modern-day technology. Housing billions of transistors, each measured to the nanoscale, the development of microchips has provided the computing power and memory needed to drive the latest digital devices.

However, the global export of these tiny silicon wafers has taken a hit from the restrictions imposed by both the US and China.

In 2022, the Biden administration updated its export controls on advanced chips and semiconductor manufacturing equipment, compelling companies that use US technology to dissociate from China’s chip factories and designers.

China has its own export controls on germanium and gallium, essential raw materials used in chip manufacturing, introduced in 2023. Beijing has also banned Micron, the biggest US chipmaker, from key infrastructure projects following a failed cybersecurity review.

The resultant disruption has influenced the outlook of industry players, prompting some to diversify their operations and move their business elsewhere. Notably, Malaysia and India saw the biggest developments in their semiconductor industries, with Malaysia leading as a hotspot for chip factories.

Malaysia leverages incentives and established role in the industry

Malaysia’s semiconductor industry has been developing over the past 50 years, specializing in the backend of semiconductor manufacturing, particularly packaging, assembling, and testing chips. Now, Malaysia is responsible for 13% of the global market for backend semiconductor manufacturing, attracting the interest of companies from China, Europe, the US, and beyond

In conjunction with the country’s rich history and experience in chipmaking, the Malaysian government has introduced incentives for manufacturers looking to invest in the country. Companies granted “Pioneer Status (PS)” enjoy tax exemption on 70% of their statutory income over a five-year period. Alternatively, companies can apply for “Investment Tax Allowance (ITA)” and receive a tax deduction equivalent to 60% of its capital expenditure within five years of the grant. This can also be used to offset up to 70% of the company’s statutory income. In addition, there are other incentives for new investments in the manufacturing sector, managed and supported by the Malaysian Investment Development Authority (MIDA).

In Penang, the state government has its own entity dedicated to supporting new investments, known as InvestPenang. The agency provides complimentary consultancy services for business location, incentives, and extends its own network of business partners, suppliers, and vendors to companies.

Malaysia’s efforts appear to have bore fruit, noting the recent influx of major semiconductor players attracted by the country’s incentives and infrastructure.

For example, Chinese tech firm xFusion, a former Huawei unit, has partnered with Malaysia’s NationGate to open its first global supply facility in Penang. The MYR 1.7 billion (USD 356.3 million) facility will supply the full range of xFusion’s products, including its latest GPU servers.

Germany’s largest chipmaker, Infineon, will be investing up to EUR 5 billion (USD 5.3 billion) in Kulim, Kedah, to build the “world’s biggest 200-millimeter silicon carbide fabrication facility.”

American giants Intel and Micron are also making bold investments into Malaysia. Micron had already opened its billion-dollar assembly and testing facility in Penang, promising another top-up of up to USD 1 billion to expand the factory capacity by 1.5 million square feet. Similarly, Intel made a USD 7 billion investment to build a chip packaging and testing facility in Malaysia, with its production expected to commence in 2024.

India follows suit with own incentives and STEM talent

Akin to Malaysia, India has also capitalized on the supply chain disruption to entice foreign chip companies with its own incentives.

In 2021, the Indian government approved its “Programme for Development of Semiconductors and Display Manufacturing Ecosystem in India,” allocating USD 10 billion toward incentives that are applicable to both local and foreign semiconductor firms.

Eligible companies looking to set up semiconductor or display fabrication facilities in India can receive fiscal support of up to 50% of the project costs. Assembly, testing, and packaging facilities can also receive fiscal support of up to 30% of capital expenditure.

The workforce in India has also been a massive pull factor. Its labor force comprises an abundance of affordable engineering talent, allowing for cost-effective employment. This can be seen in India’s dominance of chip designing, a facet in the process of chip manufacturing that requires heavy STEM talent. India makes up 20% of global chip design activity, according to a report by Information Technology and Innovation Foundation (ITIF).

Like Malaysia, India has found similar success as local developments by major semiconductor players ensue.

Micron has invested USD 825 million to construct a new semiconductor assembly and testing facility in Gujarat, India. The project is receiving fiscal support of 50% of its cost, with another 20% covered by the state of Gujarat through incentives. The combined investment is valued at around USD 2.75 billion and is predicted to be operational by the end of 2024.

Powerchip Semiconductor Manufacturing Corporation (PSMC), a Taiwanese semiconductor manufacturer, has announced a joint collaboration with India’s Tata Electronics to build India’s first semiconductor fabrication facility in Gujarat, India. According to The Economic Times, the USD 11 billion investment will also have 70% of its project cost subsidized by India’s central and state governments. Its construction is anticipated to complete in 2026.